Renters Insurance in and around Worland

Welcome, home & apartment renters of Worland!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented house is home. Since that is where you rest and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your pots and pans, exercise equipment, smartphone, etc., choosing the right coverage can insure your precious valuables.

Welcome, home & apartment renters of Worland!

Renting a home? Insure what you own.

Safeguard Your Personal Assets

It's likely that your landlord's insurance only covers the structure of the condo or townhome you're renting. So, if you want to protect your valuables - such as a dining room set, a tablet or a guitar - renters insurance is what you're looking for. State Farm agent Ken Westphal wants to help you evaluate your risks and keep your things safe.

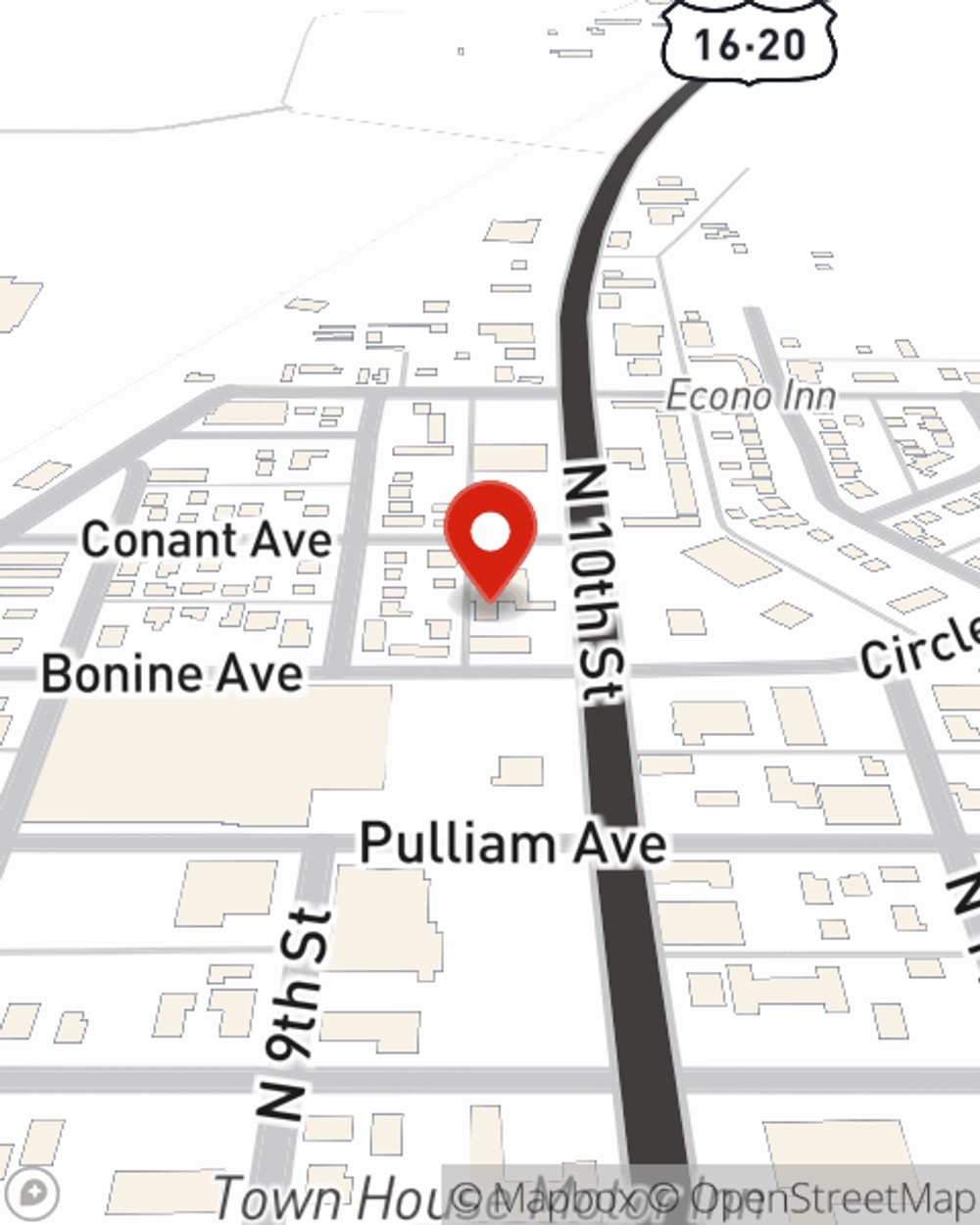

Don’t let the unknown about protecting your personal belongings stress you out! Visit State Farm Agent Ken Westphal today, and learn more about how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Ken at (307) 347-9233 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Ken Westphal

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.